- #CURRENCY TRANSACTION REPORT FILING PDF#

- #CURRENCY TRANSACTION REPORT FILING MANUAL#

- #CURRENCY TRANSACTION REPORT FILING REGISTRATION#

On June 5, 1945, as World War II was drawing to a close, the Trading With the Enemy Act was used as the statutory authority for a regulation that required financial institutions to report single cash transactions of $1,000 or more, in denominations of $50 or higher, or transactions involving $10,000 or more, in any denomination-sort of. 1945 – A Discretionary Reporting Threshold of $10,000 is Established Notwithstanding its original, limited purpose, TWEA remains in force today and, with the International Emergency Economic Powers Act (IEEPA), forms the backbone for OFAC’s economic sanctions programs. The Trading with the Enemy Act (TWEA) of 1917 was passed to prevent and restrict trade with American enemies at times of war. Those events start over 100 years ago … 1917 – Trading with the Enemy Act (TWEA) Introduced Let’s explore the timeline of events that led to the CTR threshold, and the impact each event had on that threshold.

But how and why was this transaction reporting threshold created? How did the Treasury Department first settle on $10,000 as the reporting threshold? The $10,000 cash transaction threshold, first established in 1972, is still in place today, almost fifty years later.

#CURRENCY TRANSACTION REPORT FILING PDF#

#CURRENCY TRANSACTION REPORT FILING MANUAL#

Examination Manual for Money Services Businesses PDF.Bank Secrecy Act Requirements A Quick Reference Guide for MSBs PDF.Form 105, Report of International Transportation of Currency or Monetary Instruments.Report of Foreign Bank and Financial Accounts (FBAR).

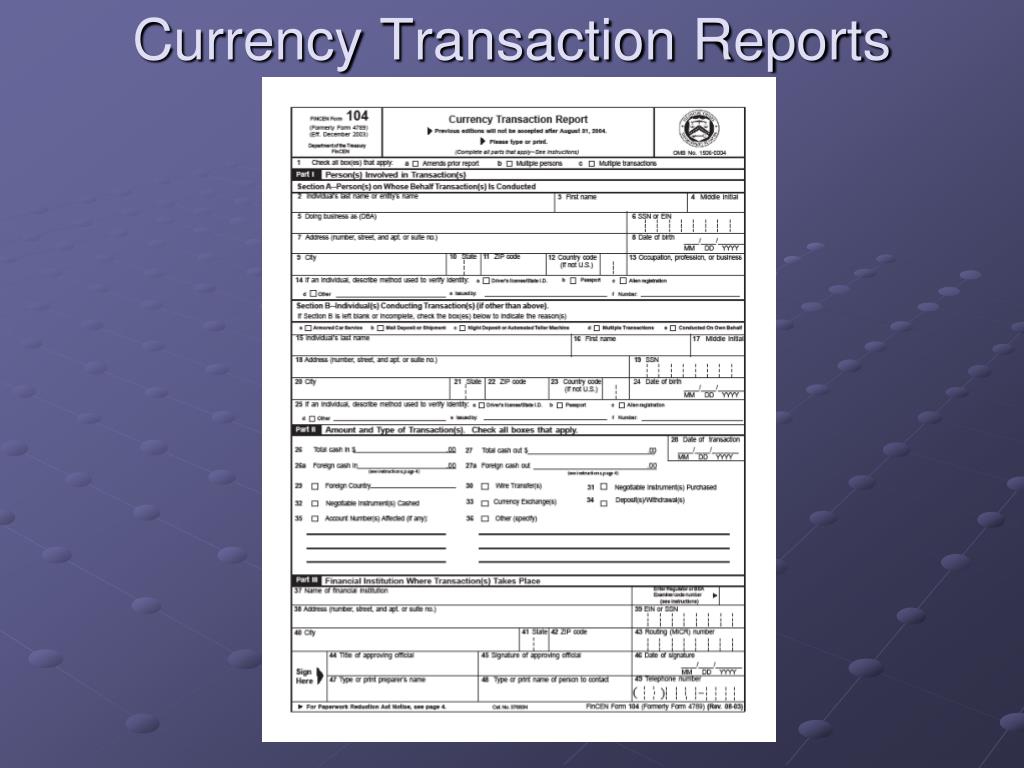

Additional Resources Other BSA Reporting Requirements FinCEN may reject any required reports filed in paper format. Financial institutions, including MSBs, must electronically file all required BSA reports using FinCEN's BSA E-Filing System. The BSA E-Filing System supports the electronic filing of BSA forms (either individually or in batches) through a FinCEN secure network. Generally, MSBs that know, suspect or have reason to suspect that the transaction or pattern of transactions is suspicious and involves $2,000 or more, must electronically file a FinCEN Form 111, Suspicious Activity Report on the activity. MSBs must electronically file FinCEN Form 112, Currency Transaction Report, when they have a cash-in or cash-out currency transaction, or multiple transactions, totaling more than $10,000 during one business day for any one person, or on behalf of any one person.

Incorporate policies, procedures and internal controls reasonably designed to assure compliance with the BSA.Designate a person to assure day-to-day compliance with the BSA.Each program must be written and take into account the inherent risks, as well as: The program should reasonably prevent individuals from using the MSB to facilitate money laundering or to finance terrorist activities. Developing an Effective AML ProgramĪll MSBs are required to develop and implement an anti-money laundering (AML) compliance program.

#CURRENCY TRANSACTION REPORT FILING REGISTRATION#

They are also required to renew their MSB registration each two-calendar-year period following the initial registration by filing another Form 107. The MSB’s owner or controlling person must register by the end of a 180-day period, which begins the day after the date they established the MSB. Registering with the Federal GovernmentĮvery MSB must register with FinCEN by electronically filing FinCEN Form 107, Registration of Money Services Business, unless a person or business is only an MSB because they serve as an agent of another MSB.

A person who engages as a business in the transfer of funds is an MSB as a money transmitter, regardless of the amount of money transmission activity. Money Services BusinessĪn MSB is generally any person offering check cashing foreign currency exchange services or selling money orders, travelers’ checks or pre-paid access (formerly stored value) products for an amount greater than $1,000 per person, per day, in one or more transactions. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN). The Bank Secrecy Act (BSA) requires many financial institutions, including money services businesses (MSB), to keep records and file reports on certain transactions to the U.S.

0 kommentar(er)

0 kommentar(er)